- Impact bond

- Homelessness

- Europe

Paris, France

10 mins

Hémisphère Social Impact Fund, France

Last updated: 17 Dec 2021

- Hémisphère Social Impact Fund, France

- Target population

- Key facts and figures

- The problem

- The solution

- The impact

- Project insights

- Hémisphère Social Impact Fund, France

- Target population

- Key facts and figures

- The problem

- The solution

- The impact

- Project insights

The Hémisphère Social Impact Fund aims to provide dedicated shelter accommodation for homeless people, refugees and asylum seekers across France.

Key facts and figures

-

Target population

Homeless people and asylum seekers

-

Investors

EUR 100m equity from seven French institutional investors and EUR 100m bank loan from the Council of Europe Development Bank

-

Provider

Adoma

-

Fund Manager

AMPERE Gestion

-

Technical Advisor

KPMG

-

Launch date

June 2017

-

Duration

11 years, with the option of a 1-year extension

-

Capital raised

€200,000,000

The problem

The Hémisphère Fund was launched in response to the challenges of providing accommodation to homeless people and asylum seekers across France. At the time of its launch in 2017, France was experiencing an increase in the numbers of homeless people and migrants seeking asylum. A 2012 report by INSEE (the French National Institute of Statistics and Economic Studies) estimated that the number of homeless people increased by 50% between 2001 to 2012, reaching 143,000. Though the study was not repeated, it is widely believed that homelessness rates continued to grow. The migrant crisis of 2015 placed additional burdens on accommodation provision where capacity was already limited.

Lack of space in dedicated shelters for the homeless and asylum seekers meant that the Government of France had to resort to accommodating people in private hotels. However, providing emergency accommodation in hotels was criticised for three reasons. Firstly, people were being housed in temporary emergency accommodation for several years due to a lack of alternative stable accommodation options. A study by SAMU Social de Paris (Paris Emergency Social Services Agency) found that on average, families had been living in emergency accommodation for 2.9 years. Secondly, the delivery of social support services is difficult in emergency accommodation solutions because they do not have the dedicated in-house staffing to deliver support services as would be found in dedicated shelters. Finally, overnight stays in hotels have a higher financial cost to the state than dedicated shelter solutions. It costs the state on average EUR 30 per a day to place an individual in a private hotel compared to around EUR 20 per a day in dedicated shelters.

The solution

In response to increasing emergency accommodation demands, the French Ministry of Housing and the Ministry of Home Affairs launched two tenders in 2016 to select operator(s) who could guarantee the provision of 10,000 temporary housing places with social support within five years of the awarding the contract. Roughly half the required places were intended for the HUAS (Hébergement d’Urgence avec Accompagnement Social) programme, which provides accommodation and social support services to homeless people, and the other half was for the PRAHDA (Programme d’Accueil et d’Hébergement des Demandeurs d’Asile) programme, which supports asylum seekers. In March 2017 Adoma, a subsidiary of CDC Habitat, was awarded all the lots for the PRAHDA tender and was also awarded close to half the places in the HUAS tender. Adoma, a social accommodation provider, would provide emergency accommodation and social support to service users; while AMPERE Gestion, a portfolio management organisation, was identified to manage an investment fund, related to the housing programme and described below.

In June 2017 seven French institutional investors committed a total of EUR 100 million to the Hémisphère Social Impact Fund. This investment was part of an innovative social impact investment arrangement linking a portion of investor remuneration to the achievement of social outcomes, as measured each year by the independent external auditor KPMG. The fund was further supplemented by a EUR 100 million loan from the Council of Europe Development Bank.

The EUR 200 million investment was partly used for the acquisition and renovation of 62 Accor hotels formerly operated under the Hôtel F1 brand18. Upon renovation there were 6,000 places of emergency accommodation available. The fund is still in the investment phase (new accommodation acquisition in progress). The fund is also being used to provide to social support services.

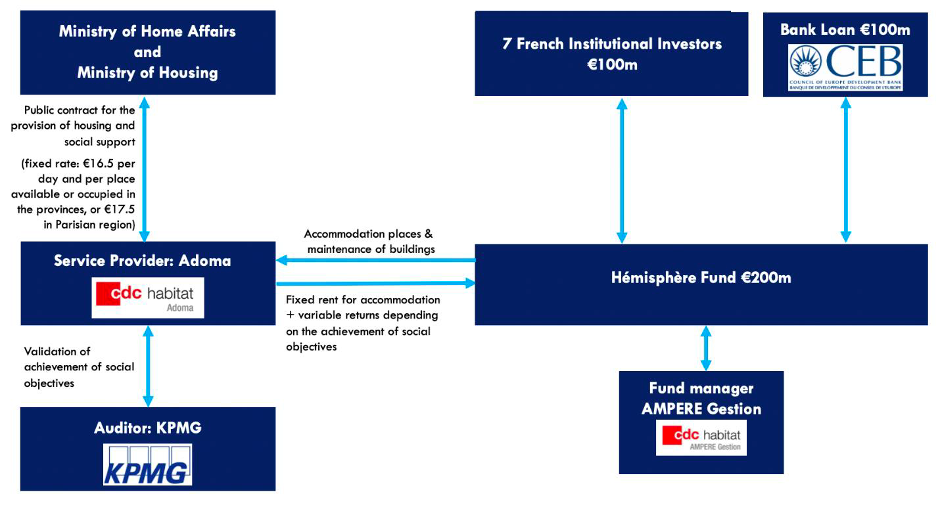

Structure of the Hémisphère Social Impact Fund

The Hémisphère Social Impact Fund is based on a social impact bond model, though the fund’s structure has differences to more conventional applications of the impact bond approach. The fund uses financial investment from institutional investors (EUR 100m equity) and a bank loan (EUR 100m) to provide capital to purchase hotel real estate or other types of residences. The French Ministry of Housing and the Ministry of Home Affairs hold a fixed rate traditional procurement contract with Adoma to deliver the social programme. Adoma pays a fixed rent for the use of the accommodation to the Hémisphère Fund, but also pays an additional variable rate depending on the social objectives they achieve. Because Adoma and AMPERE Gestion, the fund manager, are both subsidiaries of CDC Habitat it is believed that their incentives are aligned to deliver improved social outcomes rather than compete for financial gain. The EUR 200m investment is financed by the fixed rents of the hotels, the institutional investors will receive an additional variable rate based upon the achievement of social outcomes.

The structure of the Hémisphère Fund is depicted in Figure 1, and the role of each key stakeholder is briefly outlined below:

Public Contract: The French Ministry of Housing and the Ministry of Home Affairs pay a fixed daily rate to Adoma for the provision of accommodation and social support to homeless people and asylum seekers (EUR 16.5 per day and per space available or occupied in the provinces, or EUR 17.5 in the Paris region). This contract is for 11 years, though the ministries have the option to renew for a further year.

Fund Manager: AMPERE Gestion manages the Hémisphère Social Impact Fund. It is responsible for using the financial investment to purchase and renovate hotels. It now manages the Hémisphère Fund portfolio of buildings. AMPERE Gestion is a portfolio management organisation; it is a subsidiary of CDC Habitat, a public-interest real estate subsidiary of the Caisse des Dépôts (French National Promotion Bank).

Service provider: Adoma provides emergency accommodation and social support to homeless people and asylum seekers. Adoma pays a fixed rate rent to Hémisphère Fund for the accommodation units, and an additional variable rate payment is paid based upon the achievement of social outcomes.

Investors: Seven institutional investors form part of an innovative social impact investment arrangement where a portion of their remuneration is tied to the achievement of social outcomes. The Council of Europe Development Bank supplements the institutional investment with a EUR 100 million bank loan.

Auditor: KPMG conducts annual audits to confirm the level of achievement is consistent with the proof that is collected by the Adoma social workers.

The impact

How the performance score is calculated

Each year KPMG conducts an annual audit of the HUAS and PRAHDA programmes to calculate a performance score (PS). The audit process involves KPMG randomly selecting a pool of ‘positive’ cases reported (for example, a child who has attended school) and they verify the achievement against evidence (such as a school enrolment certificate) used to support the claim. Once the verification process has been completed the score of each ‘outcome indicator’ is reduced by the percentage of errors (where there was a lack of evidence to support the positive claim) found in the random sample. For example, if the auditing process identified 10% error in claim versus evidence for the children school enrolment indicator, the 95% outcome target would be reduced by 10% to 85.5%.

Outcomes achieved

Granular data on the performance scores has not been made publicly available, though end of year scores are known. The HUAS and PRAHDA programmes achieved a combined score of 43% in 2017 and 80% in 2018. Performance against the social outcome targets continued to improve slightly in 2019. The significant improvement between these years may be attributed to some extent to improvements in the way data and evidence was handled when inputted into the performance monitoring system, but a more in-depth evaluation would be required to fully understand the factors that have led to these improvements.

Outcomes framework

Within the Hémisphère Fund two programmes support two target groups: homeless people and asylum seekers, HUAS and PRAHDA respectively. Delivering both programmes, Adoma’s social workers provide personalised support to emergency accommodation residents to achieve the social outcomes outlined in table below. Adoma supports beneficiaries to enrol their children into school, identify the social welfare schemes they are entitled to and help access them, and help beneficiaries to transition to stable accommodation solutions. Indicators are the same for both the HUAS and PRAHDA programmes.

| Outputs | Metric | Outcome Target | Evidence |

|---|---|---|---|

| Children school enrolment | % of enrolled children (aged from 6 to 16) | 95% | Schooling proof |

| Personalised support | % of eligible persons who signed a personalised project | 90% | Signed personalised support project |

| Access to social rights for those who are eligible | % of eligible households who asked for social or had access to social rights (familial prestations, RSA) | 80% | Notification from the Illness Insurance primary fund or other social organisations |

| Service outcome | % of eligible households that have benefited from an exit solution | 70% | Notification of allocation of accommodation or integration accommodation |

Project insights

Fund scale and incentives

The Hémisphère Social Impact Fund has been described as one of the largest social impact bonds (SIBs) in Europe. An equity investment of EUR 100 million from mainstream investors in a social impact bond is indeed rare.

The Hémisphère Fund has separated a relatively low risk portion of the project (the real estate) from a relatively higher risk portion (the achievement of social outcomes). This separation makes this Fund different from the original concept of SIBs and especially SIBs in the UK.

Real estate is usually a relatively low risk asset class that can be rewarded with relatively low returns. The ability to keep returns low is valuable in social impact bonds where the returns may be capped, formally or informally, due to the unacceptability of paying high returns on projects designed to help socially disadvantaged populations. As relatively low returns are appropriate for relatively low risk real estate investments, the Hémisphère Fund could attract mainstream investors and achieve such a large scale. The role of the investors in the Hémisphère Fund, however, appears very different from the role of social investors in, for instance, the UK impact bond market. In the UK, social investors are putting capital at risk if social outcomes are not achieved. This is likely to be a much higher risk investment. In the Hémisphère Fund, the achievement of social outcomes puts at risk only part of the returns, not the underlying capital investment.

The alignment of incentives is also unusual when compared to more traditional impact bonds as the Ministry of Home Affairs and the Ministry of Housing pay a fixed rate, regardless of the achievement of outcomes and regardless of the occupancy rate of these accommodations. The returns in the Hémisphère Fund do not appear designed to incentivise a different behaviour from providers.

Promoting greater transparency through a focus on outcomes

From the onset, one of the core goals of the Hémisphère Fund has been to bring more transparency into the sector, particularly around the performance and value for money of support services for those in need of emergency accommodation. Setting and measuring clear outcomes linked to the services provided by Adoma was seen as key to improve the understanding of the long-term impact of these services, their levels of performance and whether they offer good value for public spending. Historically, there has been a lack of robust monitoring and independent evaluation of this type of service, and the initiators of the project felt that a focus on outcomes will help build a culture of learning and more active and effective performance management both within the provider organisation and within the public sector more widely.

While payment from the French government for the service is not contingent on achievement of specified outcomes (rather it is a fixed fee), part of the remuneration back to the investors is dependent on performance.

As explained in the Outcomes Framework section of this case study, under the Hémisphère Fund part of the remuneration paid to Hémisphère investors is fixed (the rent for the emergency accommodation spaces provided in the hotels purchased and rehabilitated by the Fund), but there is also an element of variable repayment, tied to the achievement of four outcome targets:

- Rate of enrolment in education of children aged 6-16 (95%)

- Proportion of adults who have a personalised support plan agreed (90%)

- Rate of access to social security benefits (80%)

- Rate of placements into permanent accommodation (70%)

Performance against these indicators is tracked monthly across all the different centres managed by Adoma as part of the Hémisphère Fund, and a score of social performance is calculated at the end of each year based on the progress achieved against each indicator. If all the desired levels of performance are achieved (as set out in Outcomes Framework, Table 1) then investors receive the variable repayment. Detailed performance data is not yet publicly available, but the Fund managers see scope to use the learning emerging from the Hémisphère Fund outcomes-focused approach in the provision and management of other social services. As explained by AMPERE Gestion, ‘the Hémisphere model could also be adapted and rolled out to other areas of social action, notably projects that require personalised follow-up services (e.g. job orientation and integration programmes), or programmes to finance infrastructure with a major impact on quality of life, such as social housing’.

The outcomes framework in the Hémisphère Fund is relatively simple and measurement relies on administrative data reported by the Adoma social workers themselves and verified once a year by the independent auditor. Data collection and performance monitoring systems can be expensive. The costs and administrative burden of this should be considered when deciding on the type of data that will be collected and used to measure outcomes. A simple outcomes framework, with a limited number of outcome metrics and a straightforward payment mechanism, can reduce the transaction costs and administrative burden in a social impact bond. In practice this needs to be balanced with the need to ensure that the set outcomes are effectively aligned with the long-term policy intent, relate to a clearly defined target population and are adequately priced.

Using social impact investment for the provision of public services

The use of private capital to fund public services can be appealing to government, particularly when using an outcomes-based contracting model, as it may provide the up-front working capital needed to deliver services and/or enable governments to pay for services only when specified social outcomes are achieved. Social impact investment is appealing to private companies too, because they can invest money and reasonably expect to see a profitable return on their investment whilst also achieving social impact.

However, the use of private financial capital in the provision of public services can elicit emotive responses. In particular, public policy issues can be highly politically charged. For example, Hémisphère Fund project partners had to navigate a challenging political landscape in relation to public sentiments on asylum seekers at the time of the fund’s development. On the one hand, some opposed the granting of asylum and the provision of support to asylum seekers. On the other hand, others criticised the scope for private investors to achieve additional returns on their investments as a result of their involvement in social services for these vulnerable individuals.

For the organisations involved in the development and implementation of the Hémisphère Fund, the involvement of investors who would stand to receive a higher return based on the performance of the service was seen as a way to unlock substantial funding for a large-scale initiative that, it is hoped, will deliver better social outcomes for beneficiaries in the long-term, better value for public spending, and a new model for supporting those in need of emergency accommodation.

References

Aziz Goumiri and Stéphane Saussier, Sorbonne Business School, interviewed by Mara Airoldi, Andreea Anastasiu and Leigh Crowley, The Government Outcomes Lab, University of Oxford November 2020

CDC Habitat (2017) CDC Habitat will create 6,000 units of emergency accommodation financed by Hémisphère, a social impact investment fund

Groupe SNI (2017) AMPERE Gestion completes the first round of financing of the Hémisphere Fund, the first social impact bond totalling more than €100 million

Impact Invest Lab (2018) Hemisphere a Social Impact Fund on an Unprecedented Scale in France

This case study was compiled by Leigh Crowley, Government Outcomes Lab